Reversal of Fortune: NX and CREO Find New Life in Silicon Valley

Silicon Valley, best known as a mecca for software and semiconductor development for decades, has also attracted much hardware development lately with mega software giants, Google, Facebook, Microsoft, and Amazon developing their own consumer electronics.

Yet with the transition from software to hardware, these companies are presented with new and unfamiliar challenges: longer development lead times and capital investment in tooling and parts inventory, and mechanical engineering software tools.

Software tools for Mechanical engineers and Industrial designers consist of MCAD (Mechanical Computer-Aided Design) along with PDM (Product Data Management) and, in some cases, FEA (Finite Element Analysis) for virtualizing material strength, heat flow, etc. For Industrial Designers who conceptualize the form, ergonomics and user experience, a more select class of modeling and visualization tools is used.

Currently, the “big three” MCAD tools of choice in Silicon Valley are SolidWorks, a subsidiary of Dassault Systems; CREO from PTC (formerly known as ProEngineer); and NX (formally known as Unigraphics) a division of Siemens. For ID’s, the tools of choice are Alias, an Autodesk product, Rhino and SolidWorks. In addition to creating 3D assets, ID’s also create compelling photorealistic 3D illustrations using additional visualization software like Keyshot, Photoview, Visualize, Maxwell Render, Modo, Vray, and 3dmax, some of which are plug-ins to the aforementioned MCAD products.

Yet, unlike software product development, consumer product development requires, arguably, many more disciplines (including software) to bring a product to market.

Introduced in 1995, SolidWorks has grown the fastest over the last two decades and has more in-use “seats” worldwide being used in a wide variety of product design industries. It differentiates itself from CREO and NX on ease-of-use and integration with the Windows OS. Since its introduction, it has disrupted the market–not only for it’s ease-of-use, but the price point and overall cost of ownership starting at a base price of $3995. This undercuts the other two competitors by several thousands of dollars, although in recent years the competition has lowered their entry price to be competitive.

But like the eccentric trends it is known for, Silicon Valley marches to the beat of its own drum and is fickle, and thus what the rest of industry nationally aspires to is rejected for new and different ways of working. This is no different when discussing trends for MCAD tools in Silicon Valley.

So in a reversal of fortune, it is this author’s observation that there seems to be a growing resurgence of CREO and NX in favor of SolidWorks in the valley. It initially doesn’t make sense given the popularity of SolidWorks and the advantages of ease-of-use and cost of ownership, and ease of deployment (as opposed to these disadvantages in the other two). My colleagues and I work for an engineering consultancy that services many Fortune 500 and startup companies here and that gives us a unique pulse on what is happening in their engineering departments. Given this perspective allows us to speculate and ask “why is this resurgence taking place now?”

As a designer familiar with having used all three MCAD tools, the differences between them are striking. SolidWorks and CREO use the same modeling methodology: History-Based Parametrics in which “design intent” is baked into the part and assembly files so that when changes occur in the concurrent design process environment, changes are manageable. Say, for instance, you’re designing a remote control and the product specs call for two AAA batteries. Somewhere down the road and months into the design, marketing decides that additional features are needed, which in turn requires more power budget and therefore two AAA batteries now become three AA batteries thereby requiring the physical size to grow. Since a significant (sometimes hundreds) number of features (bosses, buttons, snap features, etc.) have already been designed around two AA’s, CREO and SolidWorks can, in many cases, mitigate change efficiently by changing just a few parameters, especially if the experienced designer anticipated the change, without having to redesign each feature individually. Building designs parametrically is not unlike writing a software routine, but for geometry.

The same cannot be said about NX, and this is where it greatly differs from CREO and SolidWorks. Although NX can be driven parametrically, most engineers in the valley do not use its parametric capabilities in favor of an alternate method referred to as non-parametric (or history-free.) Granted, even in this alternate method, some intelligence is built to automate some design intent, but likely there would be many more hours spent to do what CREO and SolidWorks could do in minutes with the remote control example. And here in its apparent weakness lays its advantage. Although extremely powerful, history-based parametric design is a very thought-intensive process where a designer must carefully plan and strategize their design intent by creating many successive, interrelated features. In other words, it is not only about creating geometry, it is HOW you create the geometry and what order you create it.

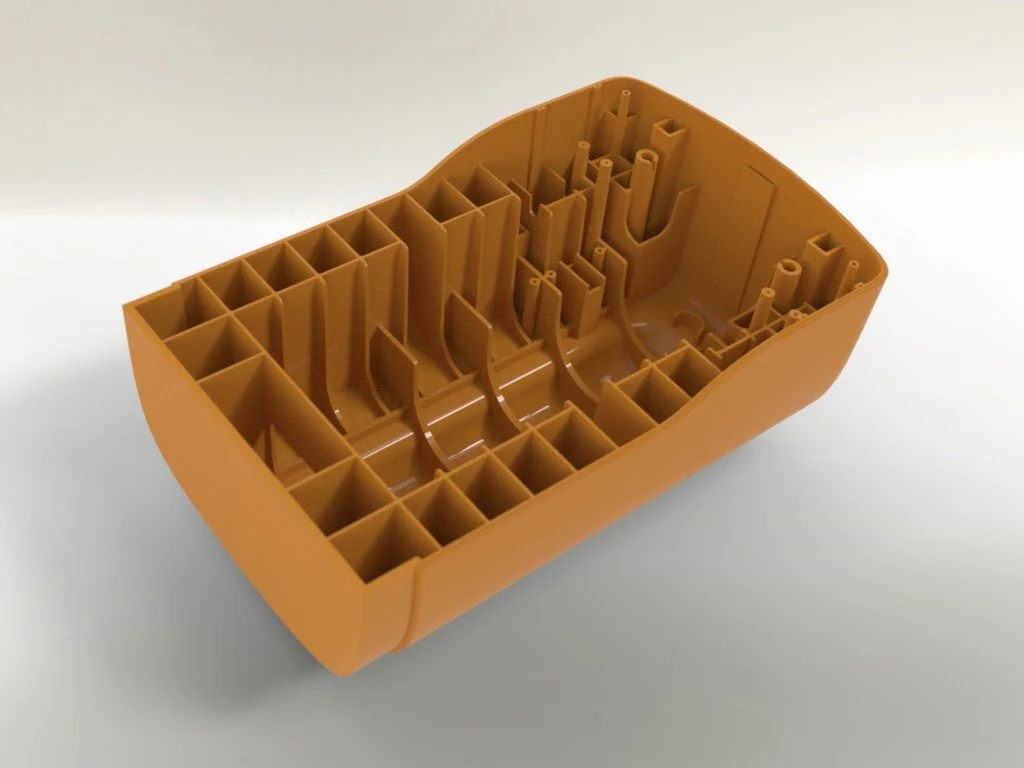

Changing the overall size of this vacuum cleaner housing (and have all the internal ribs and bosses update correctly) would be a "piece of cake" for SolidWorks users, but a "nightmare" for NX users.

Changing the overall size of this vacuum cleaner housing would be a "piece-of-cake" for SolidWorks but a "nightmare" for NX.

An additional downside of the Parametric approach is that it is not infinitely scalable. When a change is called for, simple designs comprised of 20 to 80 features can be updated in seconds. Designs with thousands of features can take minutes-to-hours to rebuild successively (computer processing). Also, with hundreds of interdependent features “baked ” into the design, the parametric approach is more prone to fail the entire design when just one or two features fail. Perhaps this is why a majority of NX users opt not to follow the parametric approach for by doing so, there’s none of the rebuild time or sequential failure issues with their parts.

Now, it is no surprise that many engineers are very “religious” about their tool of choice when arguing about which MCAD is better. It is on the level of arguing which is better: Coke or Pepsi. This is understandable given the extreme investment that engineers make with these tools using them 6 to 8 hours a day, 365. Blood, sweat and tears are invested overcoming the many software bugs and limitations in order to get their work done. To better understand their differences: SolidWorks is a more UI friendly version of CREO and NX rids itself of the pitfalls of the parametric design approach of CREO and SolidWorks. Now, I’m limiting this discussion to consumer product design and it’s worth mentioning that CREO and NX are vastly more capable tools for heavy industries like aero, automotive and shipbuilding than SolidWorks.

Getting back to the issue of resurgence of CREO and NX, there has to be more to the story than their pros and cons. Therefore, it is worth noting the history of Silicon Valley and the companies that “grew-up” in the valley. In the late 70’s, 80’s aerospace companies like McDonnell Douglas pioneer the use of 3D CAD for creating aerodynamic form. In fact, the origins of NX can be traced back to McDonnell Douglas. About the same time, Hewlett Packard championed its own homegrown MCAD tools for product design known as ME10, ME30 and Solid Designer. Interestingly, both of these MCAD tools were (at the time) non-parametric. In the late 80’s PTC’s (Parametric Technology Corporation) ProEngineer came on the scene with the parametric approach to disrupt the product design industry.

While the aerospace industry was in decline, Silicon Valley pioneers like Apple started pushing the boundaries of consumer product design and needed 3D MCAD tools that were capable of creating complex shapes, a capability lacking by many MCAD tools, with the exception of NX (at the time Unigraphics). Soon after, PTC came on the scene. The company made a smart move to incorporate competent surface modeling into early versions of ProEngineer. This starts to better explain the popularity of NX and ProE for consumer product design. Also, NX fit well into Apple’s secretive nature since NX is devoid of design intent when pasted on to their vendors.

CREO and SolidWorks have a way of “locking in” customers because of their proprietary legacy; i.e. parametric products are only backwards compatible, not forward compatible. This means in order to stay current, users are forced to upgrade in order to collaborate with other users of the software. NX differs in that most NX users do not use its parametric capabilities, opting for a non-parametric approach and therefore can collaborate freely with varying versions of NX (as well as other MCAD products) by importing/exporting their designs via industry-standard translators like STEP and IGES. This makes jumping ship from SolidWorks to NX painless, but not the other way around.

Fast-forward to 2018 and Silicon Valley is on fire with consumer product design. Companies like Google and Amazon cannot hire mechanical engineers fast enough. Coupled with decreasing company loyalty and high rates of employee turnover, companies and startups are eager to attract talented engineers and keep them. So the acquired skills they bring with them from their previous employer, I believe, in some cases play a factor when these companies hire them and thereby relax their standard on MCAD tool of choice. Once the engineer is hired, in their own interest, he/she will evangelize their tool to fellow engineers and management.

One recent example that comes to mind was a startup that I was involved with that hired a team of ex-Apple engineers. As previously mentioned, Apple has a long history of using NX as their MCAD tool of choice. So when it came time for this startup to formalize their engineering department, even though the product had been well-developed in ProEngineer, there current MCAD tool, they dumped it for NX.

I maintain that to hire (and retain) good engineers, companies consider previous MCAD skills of their new hires as a consolation (and benefit) to hiring them and perhaps even celebrate the shakeup it might cause. I’ve also heard many stories of SolidWorks users that would not hire on unless they could bring it (SW) with them. The additional benefit to the employer is that they can forgo the time and expense of training the new hire and get up to speed quickly. I see this especially with startups.

On the other hand, companies should carefully consider what MCAD tool is best for their particular industry and product. In addition, forego the infighting that can occur and the negative effects that non-standardization brings with it. CREO and NX excel in complex forms that some consumer products call for and their vast suite of specialty tools for heavy industry. Because they differ in strength and weakness, different product industries will benefit more from one tool over the other.

I will leave you with one recent story that illustrates this. My company consulted for a valley startup that had developed an initial prototype of their product in CREO. It was a highly complex consumer product with lots of electro-mechanical moving parts. CREO was a natural because of its ability to parametrically handle the interdependent mechanical nature of the design and iterate on it, especially moving mechanisms. One year into the program, the startup decided to switch to NX and the program took approximately three additional years to bring to production. If that wasn’t bad enough, at the eleventh hour they need to alter the design in a key area but were so invested with the complexity of the mechanism, they could not make the change because it would mean too much rework of the hundreds of related components. They ultimately ran out of time. In fact, they were forced to alter their target market because of this inflexibility. The product never made it to market because by this time investors were impatient and closed up shop.